It was all smiles on Sept. 30 as BMW marked the 25th anniversary of the first vehicle to roll off its Spartanburg assembly line, a singular moment that dramatically transformed the economic face of South Carolina.

A quarter-century after opening, the German manufacturer’s North American facility employs more than 11,000 workers who build 1,500 vehicles daily, a pace requiring the services of more than 40 main suppliers across the state.

The average wage among all S.C. jobs supported by the automotive industry stood at $64,120 in 2017 compared to $40,293 across all employment categories, say findings commissioned by the South Carolina Biotechnology Industry Organization.

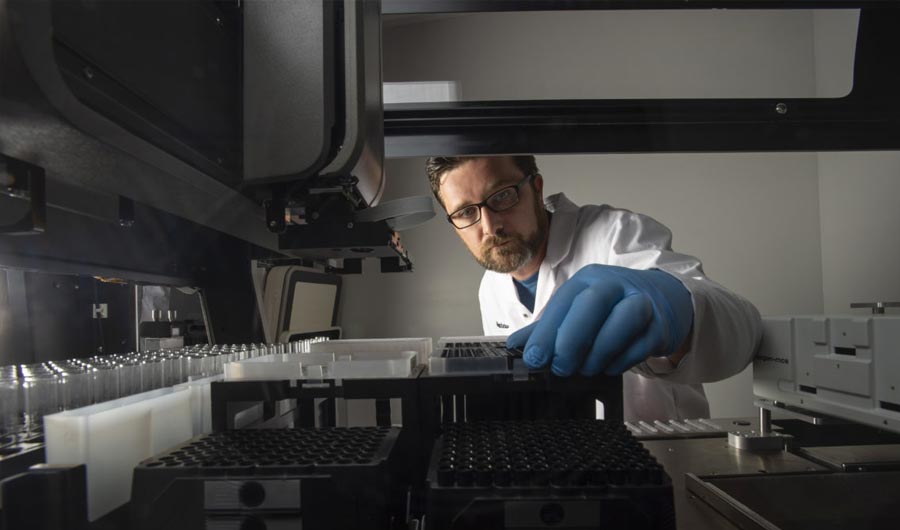

Now three years old, SCBIO is spearheading an aggressive initiative to make South Carolina the preferred location for new or expanding companies in another highly promising industry: life sciences.

As defined by SCBIO, a nonprofit public-private industry association, the life-sciences field includes pharmaceuticals and drugs, medical devices and equipment, digital health, bioscience distribution, research and testing, and bioagriculture.

Sam Konduros, the organization’s CEO, is committed to creating a robust network of partners who can provide even more of the talent and resources that the hundreds of life sciences firms already in the state need to prosper.

That ecosystem, Konduros says, includes research universities, health care providers, technical colleges and four-year institutions, bankers and investors, even contractors with a record of building biopharma facilities, and companies specializing in automation.

“We need to really get deliberate in this industry,” Konduros says.

So, can the state’s growing life-sciences industry meet or exceed the economic engine built by BMW?

On Oct. 30, representatives of the industry convened at Hyatt Regency Greenville to discuss opportunities, challenges, and pathways to making South Carolina an even stronger magnet for life-sciences businesses.

A record 445 individuals representing about 250 organizations registered for this year’s SCBIO conference, surpassing individual attendance at 2018’s meeting in Charleston by nearly 100.

Over the past two years, the number of life-sciences firms in the state has reached 678, or 276 more than identified in the 2017 study that cited the success of the state’s auto industry.

A pioneer in the field of arthroscopy engaged in new product development and medical education, Arthrex employs 150 associates at its Anderson facility, which became fully operational two months ago, with plans to reach 1,000.

Companywide, “We are doubling in size every five to six years at our current growth rate,” says Jimmy Dascani, director of health care administrator relations.

In a play on its historic textile orientation, Spartanburg-based Milliken is now producing wound and burn dressings and selling them in Asia, Europe, and the United States. Of the company’s 7,000 global employees, 400 are dedicated to the health care sector, says Geoff Haas of Milliken Healthcare Products.

“We are doubling in size every five to six years at our current growth rate,” – Jimmy Dascani, director of health care administrator relations, Arthrex

At Charleston-based Innova, founder and CEO Robert Ryan expects to close on significant new funding by year’s end.

“We’re focused on cancers where there really isn’t a good therapy,” he told the Greenville conference.

Life sciences’ total economic impact in the state now stands at more than $12 billion, with 43,000 professionals employed directly or indirectly.

While The Palmetto State has plenty going for it to help attract additional such companies — acclaimed research universities, multiple large health care systems and readily accessible infrastructure, for example — it lacks customized worker training comparable to the automotive and aerospace sectors, battles for its share of investment capital, faces strong regional competitors and is short on brand awareness as a life sciences destination, conference participants acknowledged.

Yet the potential payoff is tremendous, they say.

Average earnings among the more than 15,000 jobs supported directly by life sciences stands at $78,658.

For every 10 jobs created by the industry across the state, 19 more jobs are added.

Read more here,